Visit Site »

*Your capital is at risk

|

| Our Review Costs & Features Videos User Reviews |

|

|

Editor's Star Ratings:

| Trading Opportunities: | |

| Value for Money: | |

| Features: | |

| Ease of Use / Navigation: | |

| Market Information: | |

| Trading Advice: | |

| Customer Support: | |

| Overall Star Rating: |

Editor's Review:

Halifax Share Dealing offers investment opportunities under the banner of the long-established Halifax bank. Aside from all the usual banking option, you can also invest in shares for short term or long term opportunities, including pensions. Unlike many other online stock trading websites, most of the work is taken out of your hands with Halifax Share Dealing. The trade-off is that you’re charged an initial cost per trade. As with all online trading services, it’s important to remember that you can lose (as well as potentially gain) money.

Invest in shares for short term or long term opportunities, including pensions.

There are several account types to choose from, including Share Dealing, Stocks and Shares ISAs, Personal Pensions and ShareBuilder accounts. Your account type will vary depending on what you hope to gain from it, but we’ll look at these differences in a little detail now.

The Share Dealing Account allows you to buy international shares. There are mobile and computer options and you can set up a monthly investment plan (with a £2 commission per trade). These investment options include bonds, ETFs, funds and more. Stocks and Shares ISA accounts are tax-efficient ways to manage your stocks and shares, with options to choose your investments and invest using your Independent Savings Accounts. For longer-term investments, you might consider a SIPP (Self Invested Personal Pension), allowing you to build a retirement plan based on the markets. Finally, the ShareBuilder account provides monthly investment opportunities on UK shares, with real-time exchanges and access to a market research centre.

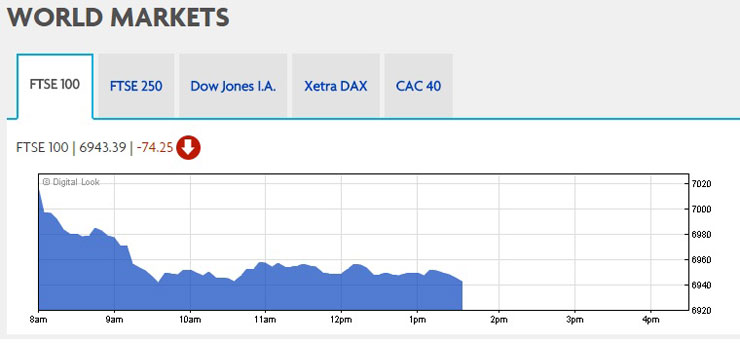

Find the latest market updates on the Halifax Market Watch pages.

There are also a variety of investment options to choose from on Halifax.co.uk. Brief details of each are provided in the “features” section of this review, with more detailed explanations provided on the website. Because Halifax is a worldwide bank used by regular people (rather than exclusively by traders and investors) their detailed descriptions are suitable for laymen, so you should get a clear understanding of the pros and cons of each option. Choose from shares, international shares, funds, ETFs, investment trusts, bonds and gilts, or structured products.

The majority of the work is taken out of your hands.

As we mentioned, the majority of the work is taken out of your hands when investing with Halifax ShareDealing. If you’d rather sit back and let the investors do their work, that’s great, but if you’re looking to take more control of your investments then you may wish to look elsewhere. Whilst market information is provided through the MarketWatch pages, the amount of control you have is limited. You can choose to buy and sell, but this is less efficient than we’ve seen elsewhere because Halifax appear to involve themselves in most stages of the process. Due to this expertise and involvement, you also have to pay per investment, which could soon add up if you wish to buy and sell regularly. As such, Share Dealing seems better suited to long-term investors.

Shares

Invest in international share options from top companies, receiving profit based on how those companies perform. All shares are traded on the London Stock Exchange, primarily through an Automatic Trading System which invests money on your behalf. You are provided with quotes on potential trades, and have the ability to confirm whether you are happy with the deal. Cheaper shares (known as Penny Shares) are also available, offering lower prices but higher risk (and potential payoffs).

Summary

Halifax seem to be a reliable resource for investments. Whilst you can take control of the money you invest with them, most of the resources are controlled by professional investors using an automated system. This means you need to trust in their investments, and wait patiently for returns. Combine that with their one-off investment fees, and it makes for a system which favours long-term investors. As such, we think it’s best suited to anyone looking to build a pension or nest-egg for the future, rather than someone looking for a faster pace on the markets.

Click on the button below to check out Halifax Share Dealer for yourself...

» Click here to visit Halifax Share Dealer

or

« Back to our Top 10 UK Online Trading Websites Reviews